Credit Score Calculation For Your Business!

Understanding how your business credit score is calculated is paramount for securing loans, favorable supplier terms, and overall financial health. This guide demystifies the complex scoring models, offering actionable insights for every entrepreneur.

Understanding Business Credit Scores

In the dynamic world of commerce, a robust business credit score is not just a number; it's a vital indicator of your company's financial reliability and stability. Lenders, suppliers, and even potential partners scrutinize this score to gauge the risk associated with doing business with you. For entrepreneurs and established businesses alike, grasping the intricacies of how this score is determined is the first step toward unlocking better financial opportunities and ensuring long-term success. A strong score can translate into lower interest rates on loans, more favorable payment terms from vendors, and even enhanced negotiating power. Conversely, a poor score can erect significant barriers, limiting access to capital and potentially hindering growth.

The landscape of business credit scoring is multifaceted, drawing from various data points that paint a comprehensive picture of your company's financial behavior. Unlike personal credit, which primarily focuses on individual debt management, business credit evaluates the financial health and payment history of the entity itself. This distinction is crucial for business owners who may have impeccable personal credit but a less-than-stellar business credit profile, or vice versa. Understanding these nuances is key to proactively managing your business's financial reputation and ensuring it aligns with your strategic objectives.

By the end of this comprehensive guide, you will possess a clear understanding of the credit score calculation for your business, the key elements that contribute to it, and practical strategies to enhance it. We will delve into the methodologies employed by major credit bureaus, highlight the differences between business and personal credit, and equip you with the knowledge to leverage your score effectively. This detailed exploration aims to empower you to make informed financial decisions, build stronger relationships with creditors and suppliers, and ultimately, foster a more resilient and prosperous business.

Key Factors Influencing Your Business Credit Score

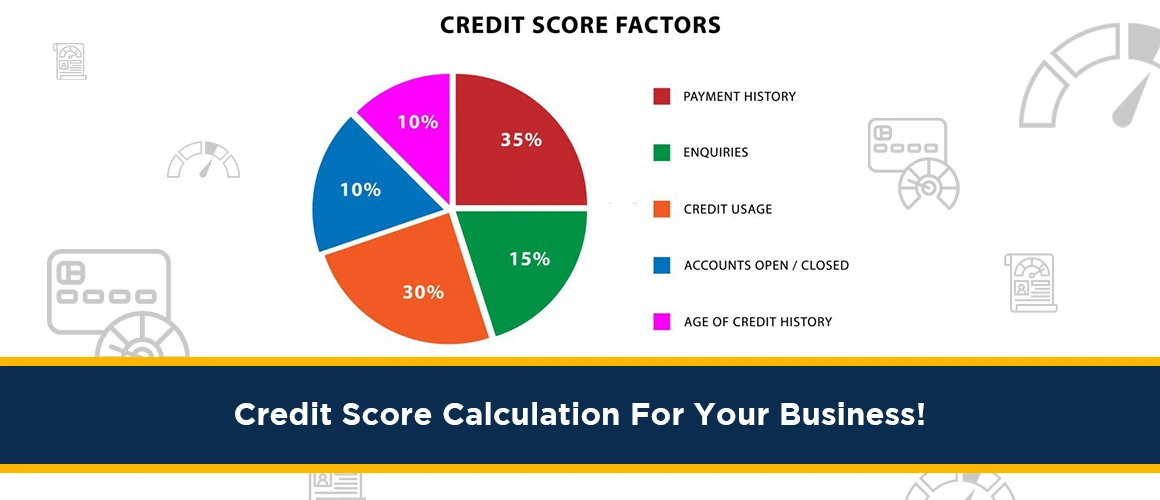

The calculation of a business credit score is a complex process that considers a multitude of factors, each contributing to the overall assessment of a company's creditworthiness. While specific algorithms remain proprietary to each credit bureau, several core elements consistently play a significant role. Understanding these key drivers is essential for any business owner aiming to build and maintain a strong financial standing. These factors are not static; they evolve with your business's operations and financial decisions, making continuous monitoring and proactive management crucial.

Payment History

The most critical component of any credit score, including business credit, is your payment history. This factor reflects how consistently and promptly your business has met its financial obligations. Lenders and suppliers look for a pattern of on-time payments to vendors, creditors, and service providers. Late payments, missed payments, or defaults can significantly damage your score. Even small delays can have a cumulative negative impact over time. For instance, if your business consistently pays its invoices 30 days late, this will be reported and will weigh heavily against your creditworthiness.

Data Points Considered:

- Timeliness of payments to suppliers and vendors.

- History of late payments, delinquencies, and defaults.

- Frequency and severity of late payments.

- Payment patterns reported by trade creditors.

In 2025, credit bureaus are increasingly sophisticated in analyzing payment trends. They don't just look at whether a payment was late, but by how much and how often. A single late payment might be less damaging than a consistent pattern of late payments. Conversely, consistently paying early or on time can build a very strong positive credit history.

credit utilization

Credit utilization refers to the amount of credit your business is using compared to its total available credit. High credit utilization can signal financial distress or over-reliance on borrowed funds. Maintaining a low credit utilization ratio is generally beneficial. This applies to both revolving credit lines (like business credit cards) and installment loans. For example, if your business has a total of $50,000 in available credit across all its credit lines and is using $40,000, your utilization is 80%, which is considered high and can negatively impact your score. Aiming to keep this ratio below 30% is a widely recommended best practice.

Data Points Considered:

- Balances on business credit cards and lines of credit.

- Total available credit limits across all credit accounts.

- Ratio of used credit to available credit.

In 2025, the emphasis on responsible credit management means that even if you pay your balances in full each month, consistently maxing out credit cards before paying them off can still be viewed negatively. It's about demonstrating that you can manage credit without being overly dependent on it.

Length of Credit History

The longer your business has been established and actively managing credit, the more data credit bureaus have to assess your financial behavior. A longer credit history, particularly one with a consistent record of responsible credit management, generally contributes to a higher score. New businesses may struggle with this factor initially as they have limited credit history to present. Building a solid track record takes time and consistent positive financial habits.

Data Points Considered:

- Age of your oldest credit account.

- Average age of all your credit accounts.

- Time since your accounts were opened and last used.

For businesses established before 2020, their longer history can be a significant advantage. Newer ventures must focus on establishing new credit lines and managing them impeccably from the outset to build this factor positively.

Types of Credit Used

A healthy mix of credit types can demonstrate that your business can manage different forms of credit responsibly. This might include installment loans (like term loans or equipment financing) and revolving credit (like business credit cards or lines of credit). However, this factor is generally less impactful than payment history or credit utilization. The key is to manage whatever credit you have effectively, rather than to simply accumulate various types of debt.

Data Points Considered:

- Presence of installment loans.

- Presence of revolving credit accounts.

- Overall credit portfolio diversity.

In 2025, while a diverse credit mix is good, it's more important that each type of credit is managed well. For example, having a business credit card and a small business loan, both with excellent payment histories, is better than having many credit lines with poor management.

Public Records and Legal Judgments

Negative public records can severely impact your business credit score. These include bankruptcies, liens, judgments, and collections. Such records indicate significant financial distress and legal disputes, signaling a high risk to potential creditors. It is imperative to address any outstanding legal or financial judgments promptly to mitigate their negative effect on your credit profile.

Data Points Considered:

- Bankruptcies filed by the business.

- Tax liens or other government liens.

- Civil judgments against the business.

- Accounts sent to collections.

The presence of any of these in 2025 is a major red flag. Businesses should be proactive in resolving any such issues immediately to prevent long-term damage to their credit score.

Business Information and Stability

While not always directly factored into a numerical score, the stability and verifiable information about your business can influence lender decisions and how credit bureaus assess risk. This includes the length of time your business has been in operation, its industry, its legal structure, and the accuracy of the information reported. A business that has been operating consistently for several years and has verifiable details is often viewed as more stable and less risky.

Data Points Considered:

- Years in business.

- Industry classification.

- Business structure (sole proprietorship, LLC, corporation).

- Accuracy and completeness of business registration data.

In 2025, with increasing data analytics, bureaus are better equipped to verify business information. Ensuring your business registration details are accurate and consistent across all platforms is crucial.

How Business Credit Bureaus Calculate Scores

The calculation of business credit scores is performed by specialized credit bureaus, with the most prominent in the United States being Dun & Bradstreet (D&B), Experian Business, and Equifax Business. Each bureau employs its own proprietary algorithms and scoring models, meaning a business might have slightly different scores across these platforms. However, they all rely on a similar set of data points to assess creditworthiness. Understanding these differences and the general principles behind their calculations is key to managing your business's credit profile effectively.

Dun & Bradstreet (D&B) PAYDEX Score

D&B's primary scoring metric is the PAYDEX score, which ranges from 1 to 100. This score is a numerical representation of a company's history of paying its bills on time. It is heavily weighted towards payment history, with a strong emphasis on how promptly trade creditors report payments. A PAYDEX score of 100 indicates that the business consistently pays its bills within agreed-upon terms.

Key Components of D&B PAYDEX:

- Payment History (80%): This is the dominant factor. It considers how quickly a business pays its suppliers and vendors, with an emphasis on payments made within net terms (e.g., Net 30, Net 60). Early payments or payments made exactly on time contribute positively, while late payments significantly reduce the score.

- Public Records (15%): Negative public records like bankruptcies, liens, and judgments have a substantial negative impact.

- Business Profile Information (5%): This includes factors like the age of the business, industry, and size, which provide context but have a lesser influence on the PAYDEX score itself.

For example, a business that consistently pays its suppliers within 30 days of receiving an invoice would likely have a very high PAYDEX score, approaching 100. Conversely, a business that frequently pays 60 or 90 days late would see its PAYDEX score plummet. In 2025, D&B continues to refine its algorithms to detect payment patterns more accurately.

Experian Business Credit Scores

Experian offers a range of business credit scores, with the most commonly referenced being the Intelliscore Plus. This score typically ranges from 1 to 100, with higher scores indicating lower risk. Experian's model is comprehensive, considering a broad spectrum of data, including payment history, credit utilization, public records, and business demographics.

Key Components of Experian Intelliscore Plus:

- Payment History: Similar to D&B, this is a crucial factor, evaluating the timeliness of payments to suppliers and lenders.

- Credit Utilization: How much credit is being used relative to the total available credit is a significant consideration.

- Public Records: Judgments, liens, and bankruptcies are heavily penalized.

- Age of Business and Credit History: A longer, established history of responsible credit use is beneficial.

- Industry Risk: Experian may also factor in the inherent risk associated with the business's industry.

Experian's model is known for its predictive power, aiming to forecast the likelihood of a business becoming severely delinquent or defaulting within a specific timeframe. A business with low credit utilization, consistent on-time payments, and no public records would typically achieve a high Intelliscore Plus. In 2025, Experian is also incorporating more data from alternative sources to enhance its predictive capabilities.

Equifax Business Credit Scores

Equifax also provides business credit scores, often referred to as the Business Credit Risk Score or Business Financial Stress Score. These scores typically range from 101 to 660 (for the Risk Score) or 1 to 10 (for the Financial Stress Score, where lower is better). Equifax's models analyze payment history, credit utilization, public records, and other financial data to predict the likelihood of a business experiencing financial distress or defaulting.

Key Components of Equifax Business Scores:

- Payment Behavior: This includes the timeliness of payments, the amount of debt owed, and the length of credit history.

- Credit Mix and Experience: The types of credit used and how well they have been managed.

- Public Records: Judgments, liens, and bankruptcies are detrimental.

- Business Size and Industry: These factors can provide context for risk assessment.

Equifax's scores are designed to give lenders a clear indication of potential risk. A business with a history of managing multiple credit lines responsibly, paying on time, and maintaining low balances will likely have a favorable Equifax score. As of 2025, Equifax continues to emphasize the predictive accuracy of its scores for various risk scenarios.

The Role of Trade References

Trade references are crucial for business credit building, especially for new businesses. When you open an account with a supplier on credit terms (e.g., Net 30), they report your payment behavior to the credit bureaus. Positive reporting from multiple trade references is a powerful way to build a strong payment history, which is the bedrock of your business credit score. It's important to work with suppliers who report to at least one of the major business credit bureaus.

How Trade References Impact Scores:

- Payment History: The primary impact is on your payment history, showing consistent on-time payments.

- Credit Utilization: If you use trade credit effectively and pay on time, it demonstrates responsible credit management.

- Building a Profile: For new businesses, trade references are often the first and most significant way to establish a credit profile.

In 2025, the importance of trade references remains high, particularly for small businesses seeking to establish credit without prior lending history. Choosing suppliers who report to bureaus like D&B or Experian can accelerate credit building.

Public Data and Its Weight

Public records, such as bankruptcies, liens, and judgments, carry significant negative weight in business credit scoring models. These are official records that indicate serious financial or legal trouble. Even if resolved, their presence on your credit report can negatively impact your score for an extended period. The severity of the impact depends on the nature of the record and the specific scoring model used by the bureau.

Impact of Public Records:

- Severe Negative Impact: Bankruptcies, especially Chapter 7, can severely damage your score for many years.

- Moderate to Severe Impact: Liens and judgments also have a substantial negative effect, signaling unresolved financial obligations or legal disputes.

- Mitigation: Prompt resolution and removal of erroneous public records are critical.

By 2025, credit bureaus are adept at identifying and processing public record data. It's vital to ensure your business is free of such records or has them officially cleared and removed from public databases.

Comparing Business Credit Scores to Personal Credit Scores

While both business and personal credit scores serve as indicators of financial responsibility, they are distinct entities with different scoring methodologies, data sources, and implications. Understanding these differences is crucial for business owners, as managing one does not automatically guarantee the health of the other. A strong personal credit score is beneficial, but it cannot substitute for a robust business credit profile, and vice versa.

Data Sources and Reporting

Personal Credit: Primarily reports information from consumer lenders, credit card companies, mortgage lenders, and auto loan providers. The main bureaus are Equifax, Experian, and TransUnion. The scores are based on individual financial behavior.

Business Credit: Reports information from trade creditors (suppliers), business lenders, leasing companies, and public records related to the business. The primary bureaus are Dun & Bradstreet, Experian Business, and Equifax Business. The scores reflect the financial behavior of the business entity.

In 2025, the lines can sometimes blur, especially for sole proprietors or small businesses where personal and business finances are closely intertwined. However, formal business credit reporting focuses on the entity itself.

Scoring Models and Ranges

Personal Credit: FICO and VantageScore are the most common scoring models, typically ranging from 300 to 850. Higher scores indicate better creditworthiness.

Business Credit: Varies by bureau. D&B's PAYDEX is 1-100. Experian's Intelliscore Plus is 1-100. Equifax's Business Credit Risk Score is 101-660. The interpretation of what constitutes a "good" score differs based on the bureau and its model.

For example, a personal FICO score of 750 is excellent. For business credit, a D&B PAYDEX of 90-100 is considered very good to excellent. Understanding these different scales is vital when reviewing your business credit reports.

Impact on Financial Opportunities

Personal Credit: Affects your ability to get personal loans, mortgages, car loans, and personal credit cards. It also influences rental applications and sometimes even employment in sensitive roles.

Business Credit: Crucial for obtaining business loans, lines of credit, favorable terms from suppliers, business credit cards, and equipment financing. Lenders use it to assess the risk of lending to your company. In 2025, many lenders are increasingly relying on business credit scores for commercial lending decisions.

It's important to note that for new businesses or sole proprietorships, lenders might still consider the owner's personal credit history if the business has little to no established credit of its own. However, as the business grows, its independent credit profile becomes paramount.

Separation of Personal and Business Finances

A fundamental principle for building strong business credit is the strict separation of personal and business finances. This means having separate bank accounts, credit cards, and loan agreements for your business. When personal and business finances are commingled, it becomes difficult for credit bureaus and lenders to assess the business's financial health independently. This can lead to a weaker business credit score and may even put your personal assets at risk if the business incurs debt.

Best Practices for Separation:

- Open a dedicated business bank account.

- Obtain a business credit card.

- Ensure all business expenses are paid from business accounts.

- Avoid using personal credit cards for business purchases, and vice versa.

In 2025, regulatory emphasis on financial transparency further underscores the importance of this separation. It not only aids credit scoring but also simplifies accounting and tax preparation.

Guarantors and Personal Guarantees

Many small business loans require a personal guarantee from the business owner. This means that if the business defaults on the loan, the owner is personally liable for the debt. While a personal guarantee links your personal creditworthiness to the business loan, it does not mean the business credit score is the same as your personal score. The lender uses both to assess risk. A strong business credit score, even with a personal guarantee, can still lead to better loan terms.

Impact of Personal Guarantees:

- Lender's Risk Mitigation: Provides an additional layer of security for the lender.

- Owner's Liability: Places personal financial responsibility on the owner if the business fails to repay.

- Influence on Loan Approval: Can be a deciding factor, especially for businesses with limited credit history.

The presence of a personal guarantee highlights the interconnectedness, but the distinct scoring and reporting mechanisms for business credit remain vital for the business's overall financial health.

Building and Improving Your Business Credit Score

Establishing and enhancing your business credit score is a strategic process that requires consistent effort and diligent financial management. It's not an overnight fix but a long-term commitment to sound financial practices. By focusing on key areas, businesses can systematically improve their creditworthiness and unlock better financial opportunities. This section outlines actionable steps and strategies to build a strong business credit profile.

Step 1: Establish Your Business as a Separate Legal Entity

Before you can build business credit, your business needs to exist as a distinct legal entity. This typically involves registering your business with the state and obtaining an Employer Identification Number (EIN) from the IRS. An EIN is like a Social Security number for your business and is essential for opening business bank accounts and applying for credit.

Key Actions:

- Register your business (e.g., LLC, S-Corp, C-Corp).

- Obtain an Employer Identification Number (EIN) from the IRS.

- Separate business and personal finances by opening dedicated business bank accounts and credit cards.

In 2025, maintaining this legal separation is more critical than ever for clear credit reporting and liability protection.

Step 2: Open and Use Business Credit Accounts

Once your business is legally established and has an EIN, you can begin opening business credit accounts. Start with accounts that report to business credit bureaus. This might include business credit cards, lines of credit, or accounts with suppliers who offer trade credit.

Types of Accounts to Consider:

- Business Credit Cards: Choose cards from issuers that report to major business credit bureaus.

- Trade Credit Accounts: Open accounts with suppliers who extend credit terms and report to bureaus.

- Business Loans and Lines of Credit: Once established, these can further build your credit history.

When applying for these, ensure you use your business's legal name and EIN, not your personal information, to build business credit.

Step 3: Pay All Bills On Time, Every Time

This is the single most important factor in building and maintaining a good business credit score. Payment history is weighted heavily by all credit bureaus. Set up systems to ensure all invoices, loan payments, and credit card bills are paid by their due dates. Automating payments or using calendar reminders can be highly effective.

Best Practices:

- Track all payment due dates.

- Set up automatic payments where possible.

- Prioritize paying trade creditors and lenders promptly.

- Even paying a day early is better than a day late.

In 2025, credit bureaus are very sophisticated in tracking payment patterns, so consistency is key.

Step 4: Monitor Your Business Credit Reports

Just as you would monitor your personal credit, it's essential to regularly check your business credit reports from D&B, Experian Business, and Equifax Business. This allows you to identify any errors, inaccuracies, or fraudulent activity that could be negatively impacting your score. Many services offer free or low-cost business credit monitoring.

What to Look For:

- Accuracy of your business information.

- Completeness of your credit history.

- Presence of any unauthorized accounts or inquiries.

- Correct reporting of payment history.

Proactive monitoring in 2025 can help you catch and correct issues before they significantly damage your score.

Step 5: Keep Credit Utilization Low

For revolving credit lines, such as business credit cards and lines of credit, aim to keep your credit utilization ratio low. Ideally, use less than 30% of your available credit. High utilization can signal financial strain, even if you pay your bills on time. If you have a $10,000 credit limit, try to keep your balance below $3,000.

Strategies for Low Utilization:

- Pay down balances frequently, even before the due date.

- Request credit limit increases on existing accounts.

- Avoid maxing out credit cards.

Maintaining a low utilization ratio demonstrates responsible credit management in 2025.

Step 6: Build Strong Relationships with Suppliers

Cultivate positive relationships with your suppliers. Many suppliers are willing to extend credit to reliable businesses. Ensure these suppliers report to business credit bureaus. This provides valuable trade references that significantly contribute to your business credit profile.

How to Leverage Supplier Relationships:

- Inquire if they report to D&B, Experian, or Equifax.

- Communicate openly about payment expectations and any potential delays.

- Consistently pay them on time to build a positive reporting history.

In 2025, these trade lines are often the first and most accessible way for businesses to build credit.

Step 7: Avoid Excessive Credit Inquiries

Each time you apply for new credit, it typically results in a hard inquiry on your credit report. While necessary for obtaining credit, too many inquiries in a short period can negatively impact your score, as it may suggest you are overextended or in financial distress. Apply for credit only when necessary and space out applications.

Managing Inquiries:

- Apply for credit strategically.

- Understand the difference between hard and soft inquiries.

- Limit applications to those you are likely to be approved for.

Responsible credit seeking is a sign of financial maturity in 2025.

Step 8: Address Public Records Promptly

If your business has any outstanding judgments, liens, or tax issues, address them immediately. These public records can severely damage your credit score. Work with legal and financial professionals to resolve these issues as quickly as possible and ensure they are cleared from public records and your credit reports.

Action Plan:

- Consult with legal counsel.

- Negotiate payment plans or settlements.

- Ensure official clearance and removal from records.

By 2025, the impact of unresolved public records remains a significant barrier to creditworthiness.

Example of Credit Improvement

Consider "Innovate Solutions," a tech startup founded in 2022. Initially, they had no business credit. They:

- Registered as an LLC and got an EIN.

- Opened a business credit card with a $5,000 limit and a net-30 account with a key software supplier.

- Used the credit card for essential software subscriptions and paid the balance in full every month, keeping utilization below 20%.

- Paid their supplier invoices consistently within 15 days.

- After 12 months, their supplier reported positive payment history to D&B and Experian.

- Their D&B PAYDEX score improved from N/A to 75, and their Experian score rose to 60.

- With this improved profile, they were approved for a $20,000 business line of credit in 2024, further strengthening their credit.

This example demonstrates how consistent, responsible credit behavior, starting small, can lead to significant improvements in business credit scores over time.

Common Misconceptions About Business Credit Calculation

The world of business credit can be complex, leading to several common misunderstandings about how credit scores are calculated and what truly impacts them. Dispelling these myths is crucial for business owners to focus their efforts on the most effective strategies for building and maintaining a strong financial reputation. Misinformation can lead to wasted time and resources, or worse, missed opportunities.

Misconception 1: My Personal Credit Score Directly Determines My Business Credit Score

While a strong personal credit score can be beneficial, especially for new businesses or when a personal guarantee is required, it is not the same as your business credit score. Business credit bureaus collect data specifically on your business entity. Factors like your business's payment history with suppliers, its age, and public records associated with the business itself are primary drivers of its credit score. Commingling finances or assuming your personal credit is sufficient for business credit needs is a common and costly mistake.

Reality: Business credit scores are calculated based on the business's financial activities and history, separate from the owner's personal credit report. Lenders may look at both, but they are distinct metrics.

Misconception 2: All Suppliers Report to Business Credit Bureaus

Not all suppliers report payment information to business credit bureaus. For your payments to impact your business credit score, you need to work with vendors and suppliers who actively report to one or more of the major bureaus (D&B, Experian Business, Equifax Business). It's important to ask potential suppliers if they offer this service when setting up new credit accounts.

Reality: You must specifically seek out and utilize trade credit from companies that report to business credit bureaus to build your business credit profile effectively. Trade lines are foundational for many businesses.

Misconception 3: Business Credit Scores Are Static

Business credit scores are dynamic and change over time based on your business's financial behavior. A score is not a permanent reflection of your business's creditworthiness. Consistent on-time payments, responsible credit utilization, and a clean public record can improve your score, while late payments or defaults will lower it. Regular monitoring is essential to track changes and understand what influences them.

Reality: Your business credit score is a living document that reflects your ongoing financial practices. Proactive management can lead to continuous improvement.

Misconception 4: Business Credit is Only Important for Large Corporations

Business credit is vital for businesses of all sizes, from sole proprietors to large enterprises. Small businesses often rely heavily on trade credit and small business loans, where a good business credit score can mean the difference between securing financing and being denied. It impacts your ability to get better terms from suppliers, rent equipment, and access capital necessary for growth.

Reality: Every business, regardless of size, can benefit from a strong business credit profile, influencing its operational flexibility and growth potential.

Misconception 5: Once a Negative Item is Paid, It Immediately Disappears from My Report

While paying off a delinquent account or resolving a judgment is a critical step, the negative mark may remain on your business credit report for a significant period, typically up to seven years, depending on the type of record and the bureau's policies. However, its impact on your score may lessen over time, and lenders will see that the issue has been resolved. It's always better to prevent negative items than to deal with their aftermath.

Reality: Negative items have a lasting impact, though their influence can diminish. Resolution is key, but the record often persists for a set duration.

Misconception 6: There's Only One Business Credit Score

As mentioned earlier, different credit bureaus use different scoring models. Dun & Bradstreet, Experian, and Equifax all have their own proprietary algorithms and score ranges. This means your business may have slightly different scores across these platforms. It's important to be aware of all your business credit reports and understand the specific scoring metric each bureau uses.

Reality: Multiple business credit bureaus exist, each with its own scoring system. Understanding all your reports provides a comprehensive view.

Misconception 7: Applying for Business Credit Cards Will Hurt My Score Significantly

While applying for credit results in a hard inquiry, which can slightly lower your score temporarily, the impact is generally less severe than with personal credit. More importantly, responsible use of business credit cards is a powerful way to build positive payment history and demonstrate creditworthiness. The benefits of having and responsibly managing business credit cards often outweigh the minor, temporary impact of the inquiry.

Reality: Strategic applications and responsible use of business credit cards are essential tools for building a strong business credit profile, and the impact of inquiries is manageable.

Leveraging Your Business Credit Score

A strong business credit score is not just a passive indicator of financial health; it's an active asset that can be leveraged to drive growth, reduce costs, and enhance your company's overall competitive advantage. Understanding how to utilize your creditworthiness effectively can unlock significant opportunities and provide a solid foundation for future success. It's about turning a good score into tangible business benefits.

Securing Favorable Loan and Credit Line Terms

Perhaps the most direct benefit of a high business credit score is the ability to secure loans and credit lines with more favorable terms. Lenders view businesses with strong credit as lower risk, which often translates into:

- Lower Interest Rates: This can save your business thousands of dollars over the life of a loan.

- Higher Credit Limits: Access to more capital for expansion, inventory, or operational needs.

- Longer Repayment Terms: Making loan payments more manageable.

- Reduced Collateral Requirements: In some cases, a strong score may reduce or eliminate the need for extensive collateral.

In 2025, with fluctuating economic conditions, lenders are particularly keen on assessing risk, making a strong credit score more valuable than ever for accessing capital.

Negotiating Better Terms with Suppliers and Vendors

Your business credit score can significantly influence your negotiating power with suppliers. A proven track record of timely payments and strong creditworthiness can lead to:

- Extended Payment Terms: Suppliers may offer longer payment windows (e.g., Net 60 or Net 90 instead of Net 30), improving your cash flow.

- Early Payment Discounts: You may be able to negotiate discounts for prompt payment, further reducing costs.

- Higher Credit Limits from Suppliers: Allowing you to purchase more inventory or materials on credit.

- Priority Service: In competitive markets, suppliers may prioritize orders from businesses with excellent credit.

This ability to negotiate better terms can directly impact your profit margins and operational efficiency.

Attracting Investors and Partners

When seeking investment or forming strategic partnerships, potential investors and partners will often conduct due diligence, which includes reviewing your business's financial health. A strong business credit score signals stability, reliability, and responsible management, making your business a more attractive prospect.

How it Helps:

- Demonstrates Financial Discipline: Shows you manage your obligations effectively.

- Reduces Perceived Risk: Makes investors more confident in their decision.

- Facilitates Due Diligence: Provides a clear, positive financial picture.

In 2025, with increased scrutiny on business viability, a robust credit profile can be a significant differentiator when seeking external funding or alliances.

Improving Insurance Premiums

In some industries, insurance providers may consider a business's credit history as part of their risk assessment when determining premiums. A history of financial stability and responsible management, reflected in a good credit score, could potentially lead to lower insurance costs.

Factors Considered:

- Risk Assessment: A stable financial profile may indicate a lower risk of business failure or claims.

- Underwriting Process: Creditworthiness can be one of many factors in determining policy rates.

While not a primary factor for all insurance types, it can contribute to a more favorable overall risk profile.

Streamlining Vendor and Creditor Relationships

A strong business credit score builds trust and credibility with your creditors and vendors. This can lead to smoother transactions, fewer requests for extensive documentation, and a more reliable supply chain. It fosters stronger, long-term relationships built on mutual trust and financial reliability.

Benefits:

- Faster Approvals: For new credit lines or account openings.

- Reduced Administrative Burden: Less paperwork and fewer credit checks required.

- Reliable Supply Chain: Vendors are more likely to prioritize and support businesses they trust financially.

In 2025, building and maintaining these trusted relationships through a strong credit score is a strategic advantage in a competitive marketplace.

Example of Leveraging a Strong Score

"GreenTech Solutions," a sustainable energy company, had a D&B PAYDEX score of 95 and an excellent Experian Intelliscore Plus. When they needed to purchase new manufacturing equipment costing $150,000, they leveraged their strong credit profile:

- Loan Approval: They secured a business equipment loan with a 4.5% interest rate, significantly lower than the 8-10% rates typically offered to businesses with average credit.

- Supplier Terms: Their primary component supplier, impressed by their credit standing, agreed to Net 60 payment terms for the large order, easing their immediate cash flow demands.

- Negotiation Power: This strong financial footing also allowed them to negotiate a better price on the equipment itself, as the vendor saw them as a low-risk, reliable customer.

By effectively using their established business credit, GreenTech Solutions saved money on financing, improved their cash flow, and secured better terms, all contributing to their continued growth and profitability.

Understanding and actively managing your business credit score is not just about avoiding problems; it's about creating opportunities. By focusing on timely payments, responsible credit utilization, and maintaining accurate records, you can build a powerful financial asset that supports your business's long-term success and resilience. In 2025, a strong business credit score is an indispensable tool for navigating the complexities of the modern business landscape.

In conclusion, mastering the credit score calculation for your business is a fundamental aspect of sound financial management. By understanding the key factors like payment history, credit utilization, and public records, and by recognizing how bureaus like D&B, Experian, and Equifax assess these elements, you can proactively manage your business's financial reputation. Remember that business credit is distinct from personal credit and requires specific strategies for building and improvement. Prioritize timely payments, keep credit utilization low, monitor your reports diligently, and leverage your strong score to secure better loan terms, negotiate favorable supplier agreements, and attract investment. Taking these steps will not only enhance your creditworthiness but also pave the way for sustainable growth and financial stability in 2025 and beyond.

Related Stories

Recent Posts

How to Build Credit from Scratch: A Beginner's Guide to Starting Your Financial Journey

Understanding the Fair Debt Collection Practices Act (FDCPA): Your Rights and Updates in 2026

The 7-Day Credit Hack: Why Your Score Now Updates Every Tuesday (and How to Use It)

What Is Debt Settlement? How It Works, Pros, Cons & Real Examples (2026 Guide)

Inaccurate Account Balances on Your Credit Report: Causes, Risks, and How to Fix Them