Credit Score vs. FICO Score What’s the Difference?

Your credit score differs from the FICO score in what ways? Should you not, you are not alone. Many people neither know the difference nor even what those numbers indicate. While your FICO score is the most often used credit score by lenders, your credit score gauges your likelihood of debt repayment. Important knowledge is the distinction between these two ratings and how they affect your borrowing choices. Allow us to examine each one more closely now.

What is a FICO Score?

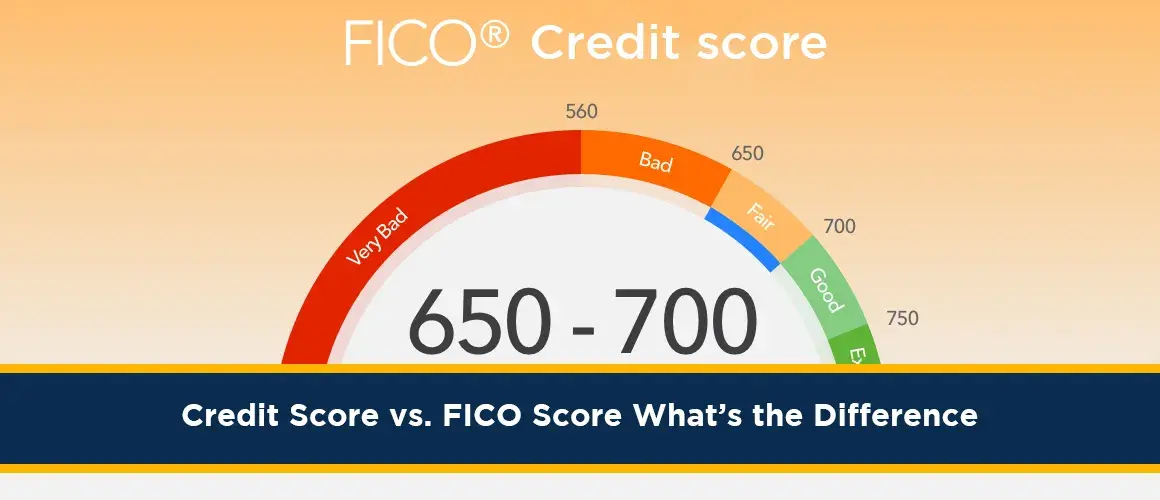

A three-digit number called a FICO score ranks your credit risk. It is based on details from your credit record, including your bill payment schedule and debt level. Your FICO range is from 300 to 850; better scores indicate reduced risk. Every year AnnualCreditReport.com offers your FICO score for free. Knowing your score will enable you to better comprehend your financial situation and, when necessary, what actions to take.

What is a Credit Score?

A credit score is a three-digit figure indicating your creditworthiness. It's based on data from your credit report, a thorough overview of your financial past. Your credit score can influence your loan approval, the loan interest rate paid, and even whether you can rent an apartment. Understanding what goes into your credit score and how you could raise it is so crucial.

The Differences: Credit Score vs. FICO Score

Fair Isaac Corporation generates FICO scores, which are then used to estimate your loan repayment likelihood. Credit bureaus compute credit scores—regulated by the Fair Credit Reporting Act—using the data included in your credit report.

Although both scores are significant, knowing the variations between them will help you to act in a way that will raise your general score.

How Lenders Use Business Credit Scores vs. FICO Scores

Ever find it interesting why your FICO score differs from your credit score? Although lenders view both scores as significant, they evaluate borrower risk using distinct scoring systems. While your FICO score employs a more sophisticated algorithm including other elements such as your existing debt and payment history, your credit score is based on data from your credit report. Knowing the variations between these two numbers will enable you to better appreciate how lenders see your risk and decide whether or not to provide loans to your company.

Conclusion: Why Bother With Business Credit Scores?

Although your credit score is crucial, lending money to a company is determined by other factors besides that. Securing funding for your company can depend just as much on a business credit score as on any other factor. If not more so. Make sure you know what a company credit score consists of and try to strengthen the credit history and rating of your firm. Though it will take some time and work, over time it will be well worth it.

Ask (888) 804-0104 and learn the difference between a FICO Score and a Credit Score.

Related Stories

Recent Posts

Understanding Your Finances: The Power of a Debt-to-Income Ratio Calculator

How to Repair a Low Credit Score: A Comprehensive Guide

Understanding FICO Scores: What’s a Good Score and Why It Matters

How to Prequalify for a Home Loan: A Step-by-Step Guide

Understanding Your Credit Score: A Comprehensive Guide to Credit Score Viewers