is Venmo safe? The security tips for scams and facts

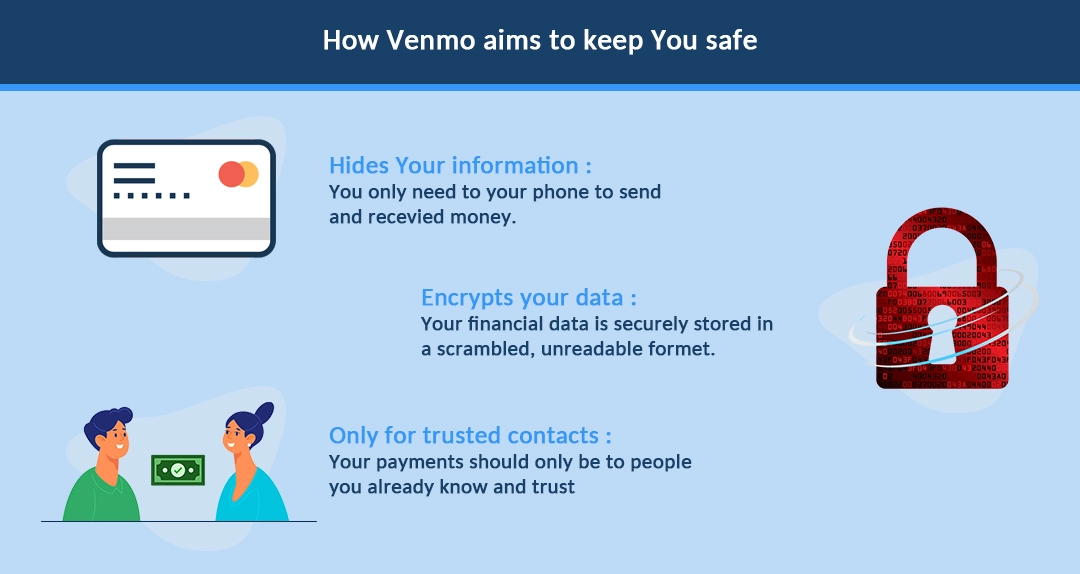

One safe and quick approach to sending money is Venmo. Venmo safeguards your data with encryption, therefore ensuring the safety of your money.

One safe approach to banking using your contacts is Venmo. Should someone have access, Venmo lets you shut down and protect your account. This tutorial offers details about typical scams, Venmo safe usage guidelines, and more.

What is Venmo?

For people who wish to send money straight to others without divulging financial information, Venmo is the ideal answer. Venmo is the ideal option for people who wish to keep their money transactions private since Venmo presents a basic and straightforward platform.

Who owns Venmo?

The fastest and freest approach to spending money is Venmo. Venmo lets you quickly pay your money free from online processing or fees!

How does Venmo work?

Venmo is the ideal method of sending money to relatives and friends. To quickly send money to anybody you know, connect Venmo to your credit card or bank account.

Venmo facilitates and quickens money transmission. You can quickly send money to your friends and relatives with Venmo, therefore relieving you of financial concerns. Keeping your money safe and secure is best accomplished with Venmo.

Venmo transaction fees

The easiest and most free approach to pay for items is Venmo. Simply utilize your peer-to-peer payment, direct deposit, or bank account. There is no more standing in queues or shopping at outside stores.

Seeking some assistance with your credit card transactions? View our 3% credit card processing charge schedule here.

Want to drop in a government or salary check? The bank gets one percent of the deposited money.

Checks deposits five percent of the time.

Get paid 1.9% plus $0.10 for every payment as a merchant.

Using Venmo, internet purchases are quick and simple. In minutes, you can also withdraw your money; to obtain even more value for your money, use the Venmo credit card.

Venmo is safe, but what about your money?

Venmo is a quick and safe approach to making payments. Still, increased convenience carries risk. Understanding Venmo's operation can help you to be safe and secure while conducting transfers.

Venmo risks

Do you worry about Venmo's security? Although Venmo includes built-in security mechanisms to guard you, various threats still exist. See whether Venmo is the appropriate payment method for you by reading our whole evaluation.

Losing your phone while logged on to the app

Noting payments to a dishonest vendor

Getting paid by a dishonest buyer

Having your password stolen

One safe and practical method of payment is Venmo. Using Venmo helps you to avoid most of the hazards involved. Venmo also gives its consumers fraud protection.

Does Venmo have buyer protection?

Venmo is a safe online payment method with fraud prevention. In some of the following contexts, your money could be safeguarded:

- Should you feel that a charge is fraudulent,

- Venmo will assist you in disputing it; should you be the victim of a cybercrime,

- Venmo will assist you in obtaining restitution; should Venmo be your main bank account, Venmo's Safe Harbor Agreement will help to protect your money.

Venmo is safe for sellers, but there are some risks.

Seeking safety while making payments? Venmo is an excellent choice! But often driven by avarice, scammers would try to profit from consumers without enough means. Make sure you stay safe online and apply advised rules.

Venmo is the perfect way to stay safe when using money.

Venmo is the ideal approach to transfer and get money free from security concerns. Venmo's additional security features—two-factor authentication and a bank account—allow you to guard yourself from identity theft and other online hazards.

- Track gadgets on your account.

Verify whether your devices are logged into your Venmo account. Eliminate those you find unfamiliar.

- Set a safe password.

Search for a Venmo password with mixability and strength. Look just at our suggested password choices here!

- Activate two-factor authentication.

Get further security by logging in using your phone! When logging in this function calls for you to input a code texted to your phone in addition to your password.

- Activate the PIN functionality.

Venmo is the ideal approach to keep in touch with relatives and friends. PIN protection lets you access the app without having to recall a four-digit number.

- Steer clear of handing money to total strangers.

Venmo is a payment tool only for those previously acquainted and trusting of one another. Venmo will not defend you if you are not happy with a transaction.

- Watch out for frauds.

Looking to purchase from a user you know not very well? Look at reviews and additional responsibility policies including a website with current contact details and customer support.

- Turn on text and email alerts.

Subscribe for our free trial right now to receive our comprehensive daily credit Report on your account activities. Additionally free access to all of our tools and push notifications and text alerts will be available to you.

- Don't let your bank card land you in hot water.

Looking to cut down on credit card charges? Many readers link their debit cards to their accounts. Debit fund transfers cannot, generally speaking, be undone.

- Track your credit.

Should your Venmo account be linked to a credit card, it is advisable to check your credit to ensure you are not missing payments or getting bogus charges. Additionally alerting you should your identity have been compromised is Credit Monitoring.

Get the protection you need against common Venmo scams.

Venmo scammers use Venmo to pilfer money from customers ignorant of Venmo's operations. Stop being a victim!

Reverse transaction frauds arise when a user cancels a credit card or bank transaction before the payment is processed. One may so lose money as well as experience embarrassment. Discover how to guard yourself against these frauds by visiting our reverseTransactionScams.com website.

Pay later frauds are If you are looking for a good or service, make sure to find out from your possible client before making a purchase! This helps to prevent any possible anarchy and keeps things flowing.

bogus screenshot frauds: Allow no one to fool you with fictitious "completed transaction" screenshots. See if the vendor has already paid you using our real-time search engine.

Venmo email frauds: If you ever receive an email requesting account information or money, most likely it is a fraud. Do not fall for it; simply keep secure and away from internet fraud!

Venmo SMS scams: con artists texting from unknown numbers persuaded consumers to disclose account details or make a transfer.

Venmo hacked an account scam. You're not alone if you have ever felt as though your transactions were being taken advantage of and that you could seem to get your money back. Hackers utilize the victim's account to make transactions; so, be cautious about the people you deal with, particularly if they look dubious. Venmo is a terrific tool for avoiding these frauds and will help you to keep yourself safe.

Criticisms of Venmo's Security Measures

Venmo is a reasonably priced, safe, private method of payment for purchases. From anywhere in the globe, anyone you know, Venmo lets you pay for goods and services.

Venmo is the worst. alternatives!

Designed as a peer-to-peer payment system, Venmo lets you quickly and effortlessly send money free from concerns about banks or institutions.

PayPal: Venmo's parent business offers additional buyer safeguards but charges more fees.

For fee-free fast transfers, this app links straight with banks.

Users of the Cash App have free debit card access and transfers.

Apple Cash and Google Pay both provide free digital payments made on mobile devices.

Cash, checks, or money orders: Still good choices are these tried-and-true payment systems.

Although it's not all-encompassing, this list should offer some well-known choices for paying and receiving money outside Venmo.

Get the most out of your Venmo transactions

Report the incident to Venmo customer support if you believe you could be a victim of fraud. After you have done that, you should give some other activities some thought.

Canceling a Venmo payment is easy!

Venmo is a safe and quick payment method that lets you pay your relatives and friends without thinking about money being lost.

How to remove a Venmo account from your phone

Should you choose to close your Venmo account, log in from a computer, then click "Cancel My Venmo Account" at the bottom.

Can you delete your Venmo history?

Seeking to keep your transaction records under wraps? You only need Venmo! This program lets users make secret transactions so you may be confident they are safe.

Venmo wants to know your SSN.

Venmo identification verification calls for users to authenticate their Social Security numbers. These situations include weekly transfers of $1,000+ to a bank or $300+ to users.

Pay your expenses, keep your money under control, and start your life back on track using Venmo, a safe and secure payment option.