What is a credit score?

Lenders evaluate a borrower's capacity to pay back a loan using a credit score, a scoring system. A high credit score indicates that the applicant probably can pay back the loan on schedule and in whole. A poor credit score would indicate that the borrower is more likely to require financial institution assistance to pay back the loan.

How do credit scores work?

A credit score influences your financial future by aggregating many elements from your financial past into one figure.

Seeking a better credit score? See a Credit Counselor to have your score brought up to par. Having a lower credit score could cause your loan interest to be higher, hence you could save money overall.

Seeking a higher credit score? From paying for services to renting a house, our credit score products may assist with everything. We can assist you in raising your credit score or simply straighten your whole financial scenario. Get in touch now for a free consultation.

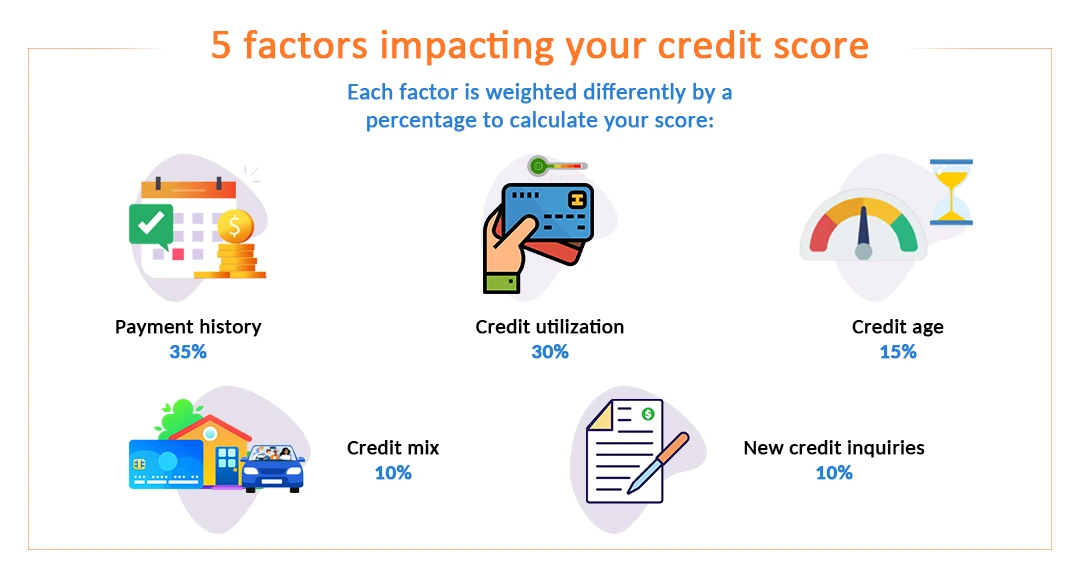

How is a credit score calculated?

- Payment history: To find out whether you have paid past-due accounts on time, simply look here quickly and simply.

- Credit use: Find out on your accounts how much credit you have and how much more would cost.

- Your credit score depends on the length of credit history you have had open. Find out how much effect your credit score has with our age of your credit history calculator.

- Credit mix: The percentage of your score that corresponds to the several credit accounts you have open is your credit mix. This covers credit cards, loans for cars and mortgages, financial accounts, and more.

- New credit: This just counts for 10% of your score and displays how much time has gone between opening new accounts.

Trying to raise your credit score? You need only look at our FICO® score comparison page. Here you may observe how your credit rating and possible borrowing expenses change with different credit ratings. Remember also that every lender has probably a distinct scoring system; so, it is advisable to compare several scores to obtain the most accurate information.

For more than thirty years, numerous lenders have applied FICO, the most widely utilized credit scoring system. Using VantageScore can help you to be confident you will be able to obtain the credit required.

These credit bureaus are:

- Experian

- Equifax

- TransUnion

What is the credit score range?

A credit score expert is the only one who knows the credit score better. Get today's free credit score!

Usually, credit score ranges:

- Poor:300–580

- Fair: 580–669

- Good: 670–739

- good: 740–799

- Amazing: 800–850

How do you check your credit score?

Several techniques are possible to check your credit score, including the following:

- We offer your credit score either free or for a fee so you may decide on your credit future with knowledge. We also have you covered should you be seeking Credit Monitoring Services.

- Seeking a free credit report from your preferred credit card issuer? Look no further than Credit CARD COMPANies, Loan Statements, and Financial Institutions. Many of these organizations give their clients free monthly credit reports so you may monitor your credit score.

- Purchase your credit score right now to better grasp your creditworthiness. Three big organizations' credit bureau data can help you to have a realistic view of your credit record.

Trying to raise your credit score? Look at it often. This will enable you to determine whether your score is rising or declining; changes don't come without notice. One of the greatest approaches to accomplish so is also reviewing your credit report.

What is considered a good credit score?

Seeking a decent credit score? View our guide to learn what constitutes "good." Although a good credit score ranges from 670 to 739, so relax if your score falls short of perfect for everything. Look no further if you want methods to raise your credit score!

Trying to cut costs on your next purchase? Improve Your Credit Score to qualify for the greatest interest rate!

Seeking to raise your credit score and obtain lines of credit approved? Our professionals can assist. Apply for cards and make consistent payments to sustain your excellent standing; this helps to keep your credit score high throughout.

Our credit score chart lists several Credit Score Ranges.

What is a good credit score to buy a house?

Searching for a house within means without breaking the budget? You only need to look at our array of lenders providing homes with a 500 credit score or above. Many of our lenders also would be eager to assist you in creating your dream house. Call us now; one of our professionals will be more than pleased to assist you!

In addition to the loan, you should also consider the following:

- Down payment total

- Closing expenses;

- types of interest rates—fixed- or adjustable-rate mortgages

What is a good credit score to buy a car?

Searching for a vehicle without stretching the budget? View our choice of reasonably priced vehicles here! With average credit scores in 2020 falling between 657 and 650, you will be likely to be qualified for a low down payment new automobile loan.

Is a perfect credit score possible?

Trying to raise your credit score? You only need to look at our custom credit counseling program! Our professionals can assist you reach an 850 Credit Score, so enabling you to at last feel comfortable about your financial future.

Few searches for new credit

Zero late payments or negative marks on your credit report; A long credit history; A credit use percentage less than thirty percent

Installments and revolving credit

Want your credit score raised a bit? Get started right now to enhance your credit history. Interviewing a man with an 850 FICO score, CNBC found that waiting is the only method to raise your age.

Do you need a perfect credit score?

Looking for a loan but with imperfect credit? Experian covers this. Americans have an average credit score of 714, hence loan application is trouble-free. Furthermore, several lenders will offer you an interest rate below the national average.

Approved for credit cards and loans with a lower credit score, utilize your better credit to pay off your bills at a remarkable speed! Today, raise your credit score and get the best interest rates available.

See your credit card, bank, or mortgage company to discuss ways to raise your credit score. Some lines of credit can also be refinanced.

What is considered a bad credit score?

We have made sure you have all the information you need to make a wise selection since we know having a low credit score can be challenging. We can assist you in search of a new house, automobile, or anything else.

How do bad credit scores happen?

Seeking means to raise your credit score? Look no further than our Bad Credit Score Elimination program. Our staff can assist you in acting to raise your credit score so you may obtain the highest possible interest rate and simpler financing. Get in touch now to find out more.

- delayed payments

- Paid missed payments

- Collections Bankruptcy

- Novel credit searches

Seeking a better credit score? View our credit history for around six months here.

How to improve your credit score?

Seeking means to raise your credit score? See our free credit report seminars here! Our professionals can assist you to better your credit score and interpret your credit history.

Seeking a better credit score? Look no further than this educational piece! This post will go over what a credit score is, how it is calculated, and how one may raise it. Understanding your credit score will enable you to make wiser financial decisions and grasp the dangers involved in applying for cards or loans.

Today, score your credit and raise your credit rating! Following particular financial selections may help you raise your credit score right now.

Early in life, open a line of credit to raise credit age; always pay on time; cut your debt; open lines of both revolving and installment credit; keep credit use as low as feasible.

Credit Repair Company can assist in raising your credit score if it is bad. Your credit report will show missing or late payments that we erase, therefore raising your score. Our knowledgeable staff can assist you to enhance your credit report and offer financial education as well.

Get a free credit repair consultation right now by calling (888) 804-0104

Related Stories

Recent Posts

Understanding Your Finances: The Power of a Debt-to-Income Ratio Calculator

How to Repair a Low Credit Score: A Comprehensive Guide

Understanding FICO Scores: What’s a Good Score and Why It Matters

How to Prequalify for a Home Loan: A Step-by-Step Guide

Understanding Your Credit Score: A Comprehensive Guide to Credit Score Viewers