What to know before applying for a bad credit card ?

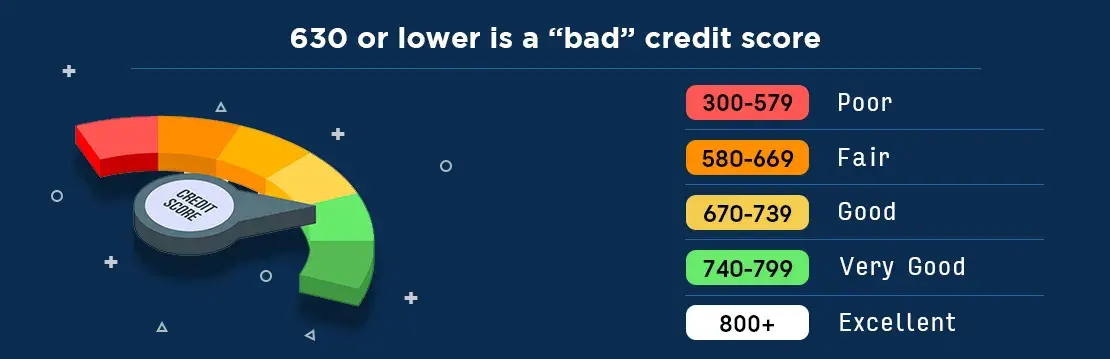

1. Know your credit score: Everyone knows you need a good credit score for buying things on credit. But what about when it comes to renting an apartment? Your landlord will want to see your credit score before agreeing to let you move in. If your credit is not up to snuff, the landlord may require you pay for a security deposit and/or rent upfront. That's just one of many reasons why knowing your credit score can be important! Know Your Credit Score is here to help with that! We'll show you how easy it is to find out where you stand with our free website or app so you know how close (or far!) from reaching your goals. It only takes minutes and there are no strings attached - we promise!

2. Find a credit card with low fees that sends credit reports: Credit reports are a key component to understanding your creditworthiness and if you're looking for a new card, it's important to find one that sends these on a regular basis. Check out our list of the best cards for low fees and helpful customer service!

With so many different choices available, finding the right credit card can be tough. That's why we've compiled this list of some of the best options available based on your needs. We'll tell you what customers like about each option as well as any drawbacks they experienced with them! This way, you can easily find an option that will work for your lifestyle and help make managing your finances easier than ever before.

3. Establish an upgrade plan: The average person only replaces their phone every 2 years. This means that many people have a device with an obsolete operating system and slower internet speeds than newer devices. If you just purchased a new phone, it may be time to think about upgrading your old one so you can enjoy all the latest features from your carrier! You might even be eligible for an upgrade plan. Some of the benefits include: faster download speeds, more storage space, increased battery life, and better security.

4. Expect your credit score to go down a few points: If you've been working hard to keep your credit score up, the last thing you want to hear is that it's going down. Well, it might be time to get used to that feeling because when you start paying off debt with a personal loan, expect your credit score to go down a few points. So what should you do? Keep reading for some tips on how to maintain and even improve your credit score while getting out of debt!

-Don't open any new lines of credit: If there are no new lines in which spending can take place and balances can be increased (i.e., opened), then this will help limit the negative impact on your credit history.

5. Don’t give up if you’re denied: With the high cost of college tuition, many people are struggling to make ends meet. Bills for housing, food, and other necessities are piling up while credit card debt is skyrocketing. With so many bills to pay it becomes difficult for some people to keep their heads above water. If you find yourself in this situation don't give up! There are different options that can help you get back on your feet!

Don't give up if you're denied from a credit card or loan application because there's always another option available! There is another option is available like credit cards for bad credit no deposit to help you in building your credit.