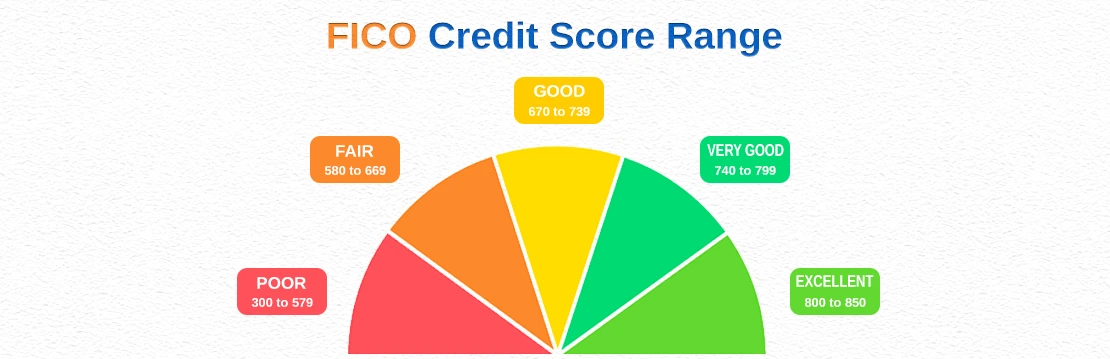

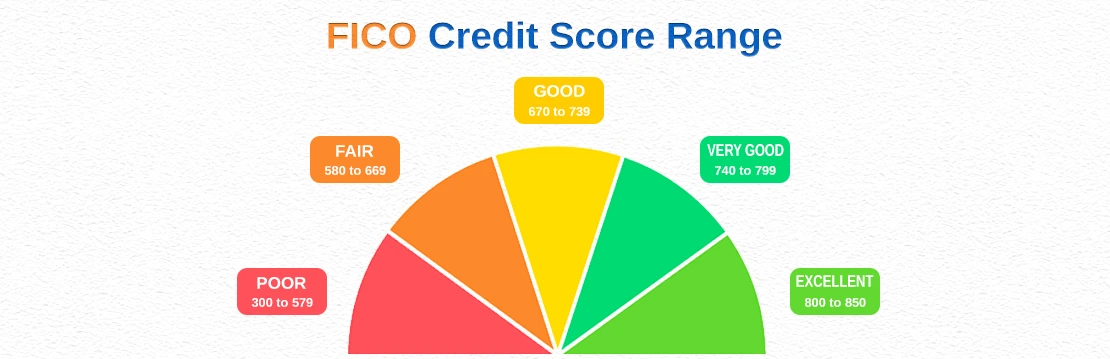

Credit score ranges

Ranges of credit scores provide creditworthiness an evaluation framework. A credit score usually ranges from 300 to 850. Poor scores range from 300 to 579, which suggests a high risk to lenders and sometimes means higher interest rates or trouble getting credit. Fair scores range from 580 to 669 and indicate both some danger and room for development. Good scores are those between 670 and 739, which suggest a reduced risk and often better lending conditions. Strong credit history and often better loan conditions are shown by very high scores, which range from 740 to 799. Best interest rates and credit chances are offered by excellent scores, which range from 800 to 850 and show outstanding credit management. Knowing these ranges enables people to assess the state of their credit and take action to raise their scores, which increases their financial prospects.

Credit score ranges typically range from 300-850. On average, a credit score in the low 700s has a 75% chance of being accepted.

- Poor: 300-580

- Fair: 580-669

- Good: 670-739

- Very good: 740-799

- Exceptional: 800-850

How to get your free credit scores?

Visit websites that provide free credit score services to get yours. Via AnnualCreditReport.com, major credit agencies such as TransUnion, Equifax, and Experian provide free credit reports once year. Your credit scores are also free to see on a lot of financial institutions, credit card firms, and personal finance websites. These sites don't charge anything, although you may have to register. Checking your credit score on a regular basis keeps you aware of your financial situation and points out any possible fraud or mistakes.

What is a good credit score and why does it matter?

Usually, a credit score between 670 to 739 is considered excellent. It represents trustworthy money management and less danger to lenders. Because it may result in better loan conditions, reduced interest rates, and higher acceptance chances for credit cards, mortgages, and other loans, a good credit score important. Because some companies check credit reports, a strong credit score may also affect insurance rates, rental applications, and even employment opportunities. A strong credit score reflects general financial health and prudence and over time guarantees greater financial prospects and savings.

What Is a Good Credit Score to Buy a House?

620 is usually considered an excellent credit score for home purchases. Although mortgages may be approved by certain lenders with scores as low as 580, your chances of getting a loan with good conditions increase with a score of 620 or higher. Greater scores—740 or higher, for example—can get you the best interest rates, which can save you money over the course of the loan. Credit scores are used by lenders to determine lending risk; a higher score translates into better loan alternatives and financial advantages when buying a house.

What Is a Good Credit Score to Buy a Car?

Generally speaking, a credit score of 661 or higher is required to purchase an automobile. Lenders classify this score range as "prime" because it entitles you to good lending conditions and interest rates. Even if you may get a vehicle loan with a worse score—600, for example—you could have to pay more in interest and have less favorable conditions. Securing the best financing offers may need a credit score of at least 720. When buying a car, keeping a strong credit score guarantees better loan alternatives and cost savings since lenders use it to assess your financial stability.

What Information Credit Scores Do Not Consider

Generally speaking, a credit score of 661 or higher is required to purchase an automobile. Lenders classify this score range as "prime" because it entitles you to good lending conditions and interest rates. Even if you may get a vehicle loan with a worse score—600, for example—you could have to pay more in interest and have less favorable conditions. Securing the best financing offers may need a credit score of at least 720. When buying a car, keeping a strong credit score guarantees better loan alternatives and cost savings since lenders use it to assess your financial stability.

What Information Credit Scores Do Not Consider

- Income: Your credit score is calculated independently of your salary, earnings, or other sources of income.

- Employment History: Your credit score is unaffected by your job stability or duration of employment.

- Age is unrelated to credit score.

- Marital Status: Your credit score is unaffected by your marital status—married, divorced, or widowed.

- Location: Your credit score is unaffected by the places you now or have lived.

- Interest Rates: Your present loans' or credit cards' interest rates are not taken into account.

- Child Support Oweds: This does not cover any payments you owe for child support.

- Money in your investment portfolios or savings accounts does not affect your credit score.

- Utilities and Rent Payments: Generally speaking, credit bureaus do not record regular utility and rent payments, hence they are excluded.

- Personal Information: Your credit score is not calculated using your gender, country of origin, race, or religion.

How to Check Your Credit Score for Free

There are several reliable ways to check your credit score for free using banks, official bureaus, and trusted online tools.

-

Use Your Bank or Credit Card App

Many banks and credit card issuers provide free monthly credit score updates inside their mobile apps or online banking portals.

Simply log in, navigate to the “Credit Score” or “Tools” section, and you can view your score along with basic insights and trends.

-

Visit Official Credit Bureau Websites

Major credit bureaus often allow you to check your credit score or report for free through their official websites.

You usually create an account, verify your identity with OTPs or security questions, and then access your score securely online.

-

Use Government or Regulator‑Recommended Portals

In some countries, official or regulator‑backed portals let you obtain your credit report or score for free at least once a year.

These platforms follow strict data protection standards, making them safer than unverified third‑party sites.

-

Sign Up for Reputable Personal Finance Tools

Trusted personal finance and credit monitoring websites offer free access to your credit score in exchange for basic personal information.

They often include features like score simulators, alerts about changes, and personalized tips to improve your **score** over time.

-

Request Your Free Annual Credit Reports

Many markets require bureaus to provide at least one free credit report per year, which you can request online, by mail, or by phone.

While the report may not always include a numeric score, combining it with free score services gives a complete view of your credit health.

How does Credit Credit Repair in My Area get your score?

Credit Repair in my area helps improve your credit score by identifying and disputing inaccuracies on your credit report. They analyze your credit history, challenge errors with credit bureaus, and negotiate with creditors to remove negative items. By correcting these mistakes, they can improve your credit profile and raise your score. These companies also provide personalized advice to manage debt and build a positive credit history. Utilizing their expertise streamlines the process and makes achieving a better credit score more efficient than trying to do it alone.

How Credit Repair in My Area Helps Improve Your Score

1. Reviews Your Complete Credit Profile

A credit specialist evaluates your credit reports from all major bureaus to spot negative items, patterns, and score-killing issues.

This detailed assessment helps build a customized strategy instead of using a one-size-fits-all approach to your score.

2. Identifies Errors and Outdated Negative Items

The team looks for inaccurate late payments, duplicate accounts, wrong balances, and accounts that do not belong to you.

Fixing these mistakes can quickly improve your score because credit bureaus must remove information that cannot be verified.

3. Disputes Inaccurate Information with Bureaus and Creditors

Credit Repair in My Area prepares and sends formal disputes to credit bureaus to challenge incorrect or unverified negative entries.

They also contact creditors or collection agencies directly when needed to validate debts or negotiate removals and updates.

4. Builds a Customized Credit Repair Plan

You receive a step-by-step plan that prioritizes which debts to tackle, what actions to avoid, and how to rebuild positive history.

This structure keeps you focused on changes that can move your score in the right direction in the shortest realistic time.

5. Guides You on Smarter Credit Habits

Experts coach you on reducing credit utilization, paying on time, avoiding unnecessary inquiries, and managing new accounts wisely.

Better daily habits make sure your score not only rises but stays strong long after the repair process.

6. Monitors Progress and Updates You Regularly

The company tracks bureau responses, new reports, and score changes, then adjusts the dispute strategy when required.

You stay informed through ongoing updates so you always know what has been removed, what is pending, and what to expect next.

7. Offers Transparent, Support-Driven Service

Many credit repair providers emphasize clear timelines, no-hidden-fee structures, and dedicated account managers for ongoing support.

This combination of expert work plus personal guidance makes it easier to stay committed until your credit health meaningfully improves.