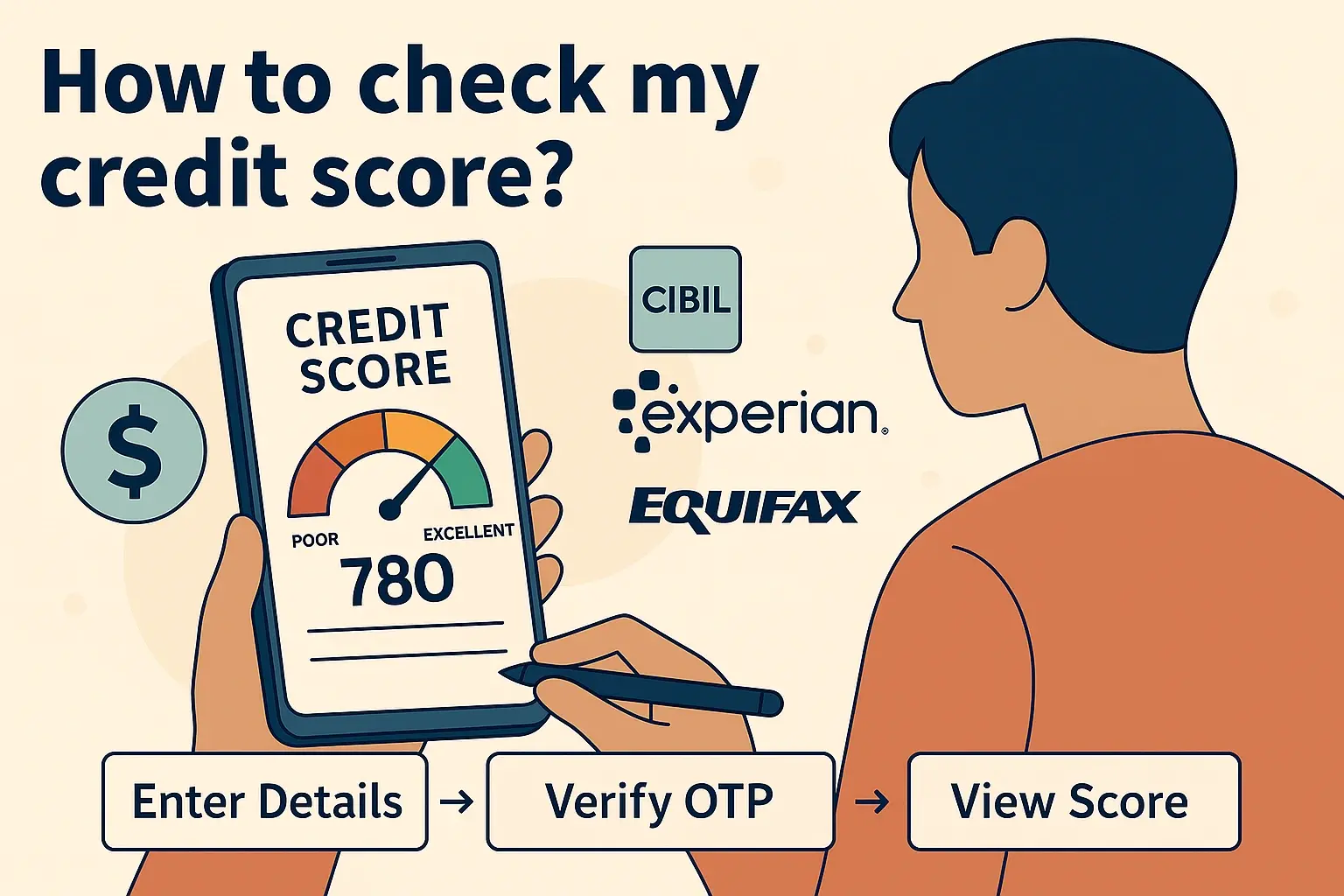

How to check my credit score ?

Your credit score is a vital component of your financial health, influencing your ability to secure loans, credit cards, housing, and even certain job opportunities. Knowing how to check your credit score and understanding what it represents empowers you to make informed financial decisions. In this comprehensive guide, we’ll explore various methods to check your credit score in the USA, using only USA-based data, and provide actionable tips to improve it.

What is a Credit Score?

A credit score is a three-digit number, typically ranging from 300 to 850, that reflects your creditworthiness based on your credit history. The two most common scoring models are FICO Scores and VantageScores. A higher score indicates better creditworthiness, increasing your chances of loan approvals and favorable interest rates. Lenders, landlords, and even some employers use this score to assess your financial reliability.

Why is Your Credit Score Important?

Your credit score impacts several areas of your life:

-

Loans and Credit Cards: Lenders rely on your score to approve applications and determine interest rates.

-

Housing: Landlords may review your score to evaluate your reliability as a tenant.

-

Employment: Certain employers check credit reports for roles involving financial responsibilities.

-

Insurance: Some insurers use credit scores to set premium rates.

Regularly checking your score helps you stay informed and address any issues promptly.

How to Check Your Credit Score for Free

Several reliable methods allow you to check your credit score at no cost. Here are the most accessible options:

1. Credit Karma

-

Overview: Credit Karma provides free credit scores from TransUnion and Equifax, along with credit reports and monitoring tools.

-

Access: Sign up on their website, verify your identity, and view your scores instantly.

-

Features: Offers personalized recommendations to improve your credit and insights into factors affecting your score.

2. TransUnion

-

Overview: TransUnion offers a free VantageScore 3.0 credit score, no credit card required.

-

Access: Register on their website to access your score, credit report, and monitoring services.

-

Features: Includes credit monitoring, alerts for significant changes, and personalized offers.

3. Experian

-

Overview: Experian provides a free FICO Score and credit report.

-

Access: Sign up on their website to view your score immediately.

-

Features: Includes Experian Boost™, which can enhance your score by factoring in positive payment history for utilities, cell phone bills, and eligible rent payments.

4. Bank and Credit Card Providers

-

Overview: Many banks and credit card issuers offer free credit scores to customers.

-

Example: U.S. Bank provides a free VantageScore from TransUnion for customers with any U.S. Bank account.

-

Access: Log in to your bank’s mobile app or online banking portal. For U.S. Bank, navigate to “View credit score” under “Help & services” in the app or “Shortcuts” online.

-

Features: Offers weekly score updates, a credit report, a score simulator, and personalized recommendations via TransUnion’s CreditCompass™. Viewing your score has no impact on your credit.

|

Method |

Score Type |

Frequency |

Additional Features |

|---|---|---|---|

|

Credit Karma |

VantageScore (TransUnion, Equifax) |

Instantly upon signup |

Reports, monitoring, recommendations |

|

TransUnion |

VantageScore 3.0 |

Instantly upon signup |

Reports, monitoring, alerts, personalized offers |

|

Experian |

FICO Score |

Instantly upon signup |

Reports, Experian Boost™, monitoring |

|

U.S. Bank |

VantageScore (TransUnion) |

Weekly updates |

Reports, score simulator, CreditCompass™ |

How to Get Your Free Credit Report

Your credit report provides a detailed view of your credit history, which forms the basis of your credit score. Federal law entitles you to one free credit report every 12 months from each of the three major credit bureaus: Equifax, Experian, and TransUnion.

-

Access: Visit AnnualCreditReport.com, the official government-authorized site, to request your reports.

-

Options: Request all three reports at once or stagger them throughout the year for more frequent monitoring.

-

Note: Credit reports typically do not include your credit score but detail your credit accounts and payment history.

Understanding Your Credit Report

Your credit report contains critical information, including:

-

Personal Information: Name, address, Social Security number.

-

Credit Accounts: Details of loans, credit cards, balances, and payment history.

-

Payment History: Records of on-time or late payments.

-

Public Records: Bankruptcies, liens, or other legal matters.

-

Inquiries: Lists of who has accessed your report, including hard inquiries from lenders.

Reviewing your report regularly helps identify errors that could lower your score. If you find inaccuracies, you can dispute them directly with the credit bureaus.

Paid Methods to Check Your Credit Score

For those seeking more comprehensive services, paid options are available:

-

Credit Bureaus

-

Purchase your score directly from Equifax, Experian, or TransUnion.

-

These scores may use different models or provide more detailed insights tailored to specific lenders.

-

-

Credit Monitoring Services

-

Services like Experian IdentityWorks or TransUnion SmartMove offer ongoing monitoring, identity theft protection, and additional features for a monthly fee.

-

Ideal for those wanting enhanced security and detailed credit tracking.

-

Tips for Improving Your Credit Score

Improving your credit score can enhance your financial opportunities. Consider these strategies:

-

Pay Bills on Time: Payment history is the most significant factor in your score. Use reminders or automatic payments to avoid late payments.

-

Keep Credit Utilization Low: Aim to use less than 30% of your available credit to avoid negatively impacting your score.

-

Monitor Your Credit Report: Regularly check for errors and dispute inaccuracies promptly.

-

Limit New Credit Inquiries: Hard inquiries from new credit applications can temporarily lower your score. Apply for credit only when necessary.

Common Myths About Credit Scores

Misconceptions about credit scores can lead to confusion. Here are some myths debunked:

-

Myth: Checking your credit score lowers it.

-

Fact: Checking your score is a soft inquiry and does not affect your credit.

-

-

Myth: Closing old accounts improves your score.

-

Fact: Closing accounts can reduce your credit history length and available credit, potentially lowering your score.

-

-

Myth: Only those with poor credit need to check their scores.

-

Fact: Everyone benefits from monitoring their score to maintain financial health and catch errors early.

-

Conclusion

Checking your credit score is a straightforward yet powerful way to take control of your financial future. Free resources like Credit Karma, TransUnion, Experian, and bank-provided tools make it easy to stay informed. Your credit score is more than just a number—it reflects your financial habits and can unlock better opportunities. Regularly monitor your score and credit report, and take proactive steps to improve your credit health.

Call (888) 804-0104 to get your credit score now!

Related Stories

Recent Posts

How to Build Credit from Scratch: A Beginner's Guide to Starting Your Financial Journey

Understanding the Fair Debt Collection Practices Act (FDCPA): Your Rights and Updates in 2026

The 7-Day Credit Hack: Why Your Score Now Updates Every Tuesday (and How to Use It)

What Is Debt Settlement? How It Works, Pros, Cons & Real Examples (2026 Guide)

Inaccurate Account Balances on Your Credit Report: Causes, Risks, and How to Fix Them